Are you keeping up with technology? If you aren’t, it’ll leave you behind. Especially in the accounting industry, where continually evolving financial software has a lot to offer, but only if you know about it.

4 Ways Technology Is Changing The Accounting Industry

It can be easy to fall behind on other matters when you’re focused on your work – but that doesn’t make it OK, especially with IT. You have a responsibility to yourself and your clients to stay aware of how new technology can improve the work you do every day.

You can’t stop technology from changing – it’ll keep evolving and improving, no matter how much you ignore it.

This is important to note because as technology changes, it drags the world along with it. This includes the business world, and the accounting industry specifically.

As technology evolves, it affects the way people do business, and what your clients will expect of you. Just like how technology has likely changed the way you work with your San Jose IT company.

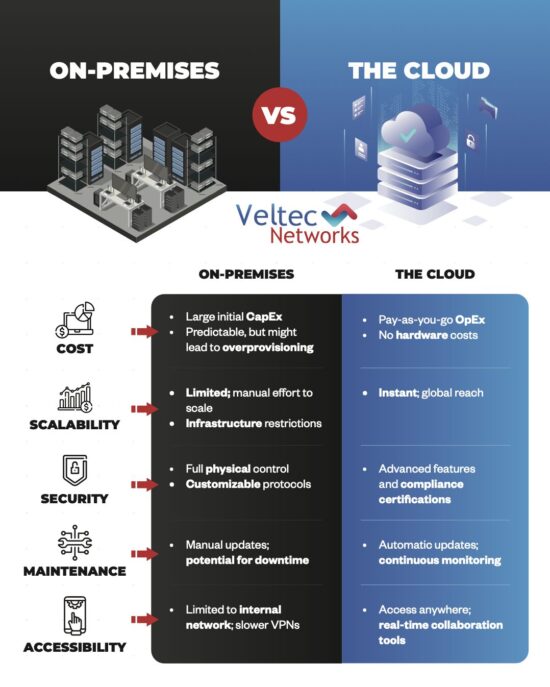

Just as you wouldn’t want a client to see you using a slide rule or an abacus today, eventually, you wouldn’t want to have to tell them you don’t have cloud-based software.

It’s just the reality of how technology and business are intertwined.

The accounting industry has seen many radical changes in technology over the past decade, and many companies are trying to find ways to continue to catch up without having to repeatedly invest in the “new tech” every few years.

Here are the 4 most major technology changes that are currently faced by the accounting industry — and what you can do about it:

1. Automation

Bookkeepers are practically obsolete, and that’s not something that’s making everyone happy.

On one end, accounting companies are now able to vastly reduce the amount of staff they take on. On the other hand, that also means fewer people in the accounting industry in general… it means careers that are shrinking.

Long-term, there are going to be fewer accountants and financial advisors, because there simply isn’t the need for any “busy work.”

It’s not only that transactions are being automatically recorded, but it’s also that they are automatically analyzed.

Tools are now being used for many of the things that accountants used to do, such as provide quick depreciation schedules. And because the technology is so simple and easy to use, they often don’t even need an accountant to explain the results to them.

In the short-term this means industry disruption — but in the long-term this is is a positive thing. Accounting firms need fewer people and more technology, and they will be able to invest far less money into maintaining their overhead.

Accounting firms will also be able to demand the best talent because the industry is going to be even more competitive.

2. Availability

In the old days, it wasn’t uncommon for partners to get the middle of the night calls from their panicked clients. But this is even worse now that email, text messaging, and other avenues are open.

Accountants can now expect to be “on call” to their clients almost constantly, and it’s not as simple as having business hours — the competition is answering their calls, so you need to too.

This means that there may be fewer accountants working in the data analysis areas (where technology is taking up the slack), but more accountants working directly with customers.

Accounting is likely shifting to a more human-centric approach, helping individuals reach their business and personal financial goals rather than dealing with raw numbers. But this also means that people skills are going to become paramount, and accountants are going to have to get used to office hours that potentially don’t end.

3. Processes

Accountants who are graduating now have never dealt with paper tax forms, nor have they had to deal with sending in paper documents to the IRS or manually compiling payroll.

In fact, many accountants are not used to setting up their own algorithms or doing their own accounting at all; all of the software now handles it for them.

For larger firms and older firms, this can be a bit difficult to work with. Accountants are no longer being taught many of the more basic fundamentals; instead, software solutions are doing the heavy lifting.

For the most part, this really doesn’t make a difference – the work still gets done. But for more complex cases, this can lead to mistakes or things being overlooked, simply because the accountants have no experience in it.

Accounting firms may need to adjust to this through training sessions and through on-the-job learning. Internships may need to be more intensive, and new hires may need to be introduced to some basic accounting principles. On the other hand, they will often already know how to use the leading software solutions.

4. Knowledgeable Clients

Finally, accountants are going to see their roles shift and possibly shrink a bit.

Many people are now doing everything from their taxes to their investing on their own and they are rarely looking for an accountant unless they need something special done — such as opening a business.

Accountants are going to see fewer casual clients and walk-ins. Those who rely on individual tax returns or individual advising for the bulk of their business are going to be the hardest hit.

This is going to be mitigated somewhat by the fact that accountants are now able to reduce their workforce, but accountants who want to remain healthy and competitive are going to need to be more aggressive with procuring clientele — and they may need to start offering more accurate services, such as portfolio analysis and business management.

Technology is changing the accounting industry not only quickly but also permanently. These are not trends: these are things that accounting firms are going to need to deal with for the foreseeable future, and so it would be wise to talk to your San Jose IT company about it.

Accounting firms need to understand that many of the services that they provide are going to be rendered all but obsolete in the next decade.

The role of the traditional accounting firm is going to need to advance to a technology-focused, customer-centric business model to survive – a San Jose IT company will be able to help.

Like this article? Check out the following blog on the accounting field to learn more: