How Is Your CPA Firm Securing Client Data?

As your accounting firm knows, you have a legal and ethical responsibility to protect client data, under various laws and regulations. With this in mind, is your CPA firm in compliance with IATA cybersecurity regulations? The International Air Transport Association has published accounting guidelines that apply across the industry, outlined later in this article.

Unfortunately, many CPA firms are yet to comply with these regulations. What, then, is the answer to securing your privacy? Before delving into this question, here are some crucial business tips to keep in mind about your business cybersecurity in protecting your clients’ data.

Cybercriminals work round the clock trying to devise new ways to commit cyberattacks. To them, this is a full-time job, and all businesses, both large and small, are attractive targets. This is important to know, since you’re not immune to ransomware and other cyber incidents that could bring your business to its knees.

2. Hackers are finding easy ways to access business networks and data.

If you don’t train your employees on the dangers of cybercrime, they will continue to be the entry points that hackers target to access your business data. Irrespective of your business size or the loss that results, hackers will keep attacking you as an attractive target. One of the reasons CPA firms keep being attacked is that they hold myriads of valuable data that hackers can exploit for profit. Statistics show that the cybercrime crime industry is enormous, with forecasts predicting that it will reach approximately $170 billion in 2022.

3. How easy is it to protect your business?

Securing your business data and networks plays a role in protecting your business against cybersecurity threats. Seeing that cybercrime is becoming a lucrative business, you need to take measures to protect your business and client data.

The first step is to have a written security plan that serves as your business continuity plan. The plan should:

- Include the names of all information security program managers

- Identify all risks to customer information

- Evaluate risk and current safety measures

- Design a program to protect your business and client data

- Put the data protection program in place

- Regularly monitor and test the program

Secondly, you also need to work with a professional service provider in securing your data. Once you select a service provider, ensure you have a written contract that outlines the rules and policies that govern your partnership. Your service provider will:

- Help your business maintain appropriate safety measures

- Oversee the handling of customer information

- Revise the security programs as required.

IATA’s Directive for Cybersecurity Requirements

IATA’s directives comprise six security requirements for protecting your CPA firm from cyber incidents:

1. Antivirus software

This is crucial for scanning your computer files and memory for specific patterns that indicate the presence of malicious software on your devices. Antivirus vendors need to find issues and update malware definitions multiple times a day. On the other hand, you must keep up with these updates and install the latest software updates.

2. Firewalls

These play a crucial role in protecting your business systems and networks against external attacks. They work by shielding your computers from unnecessary web traffic and malicious attempts at accessing your business environment. They also block malicious software from taking over your systems.

The next-generation firewalls are known as Unified Threat Management and come as a combination of hardware and software. They comprise the Intrusion Detection Systems and Instruction Prevention Systems for detection and prevention of intrusion, respectively.

3. Two-Factor Authentication

Two-factor or multi-factor authentication offers an extra layer of security to your applications, networks, and systems beyond a password. The system prompts users to provide an authentication factor that is randomly generated and only accessible to them for a limited time. Without access to this additional security factor, a malicious actor or anyone without authorization cannot access the system.

4. Data Backup Software or Services

If your company loses crucial data due to human error, a cyberattack, or natural causes like floods, you need to recover it to continue with operations. This is where the importance of data backup software or services comes in. A data backup strategy is not a one-day event, but should be an integral part of your cyber hygiene. Having a backup plan gives you peace of mind knowing that you have a way to restart your company’s archive in the event of a system crash or cybercrime.

Security experts from the government recommend using the 3-2-1 rule in backing up your data. This means that you should have three copies of all your data, including the production data. Two of these copies must be in two different media, with one of them stored in an offsite location for disaster recovery.

5. Drive Encryption

Your CPA firm handles sensitive client data on computers, which are prime targets of attack by malicious actors. This data may also become compromised internally by unknown actors. To be on the safe side, IATA recommends using drive encryption software.

Also known as disk encryption, drive encryption transforms the data on your computer into unreadable files. This way, only people with the authorization to access that data can do so.

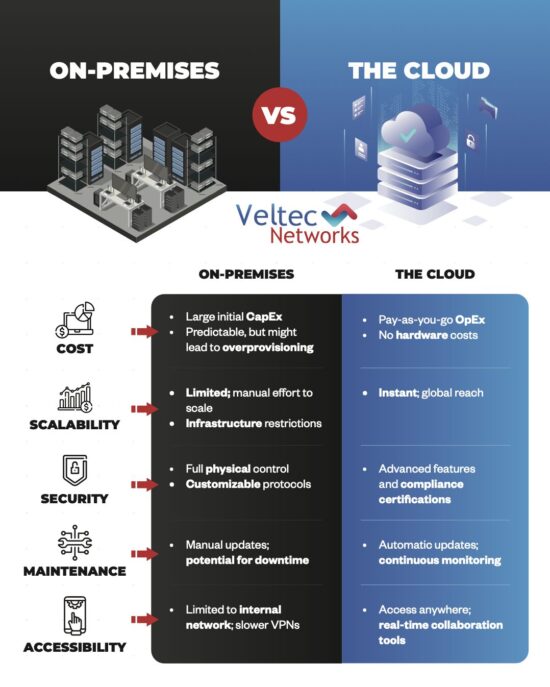

6. Virtual Private Network

As the business world shifts to remote work, many tax firms’ employees need to occasionally connect to unknown networks as they work remotely. As such, your firm should establish an encrypted virtual private network for a more secure connection.

With a VPN in place, data is transmitted over a secure, encrypted tunnel between remote users and the company network over the internet.

Final Thoughts

The security of your CPA firm is crucial, primarily because you handle sensitive client data whose compromise could land you in trouble. To prevent this from happening, ensure you draw up a business continuity plan and follow the IATA’s guidelines for cybersecurity.

All this may sound overwhelming for your small business, but it is easy to do with the help of a CPA or accounting IT expert. Don’t struggle alone with securing client and business data in your CPA firm because experts from Veltec Networks can help you. Contact us today to schedule a consultation about this and all your business IT needs.