Section 179 of the IRS tax code was designed as part of the U.S. government’s incentive to encourage businesses to purchase equipment and invest in their business. Section 179 allows businesses to deduct the entire purchase price of qualifying equipment and/or software financed or purchased during the tax year.

Section 179 of the IRS tax code was designed as part of the U.S. government’s incentive to encourage businesses to purchase equipment and invest in their business. Section 179 allows businesses to deduct the entire purchase price of qualifying equipment and/or software financed or purchased during the tax year.

Section 179 doesn’t increase the amount you’re able to deduct. It does, however, allow you to obtain your entire depreciation deduction in one year, instead of taking it over the term of an asset’s useful life, which can be a long time. This is often referred to as Section 179 expensing, or first-year expensing.

How Do I Know if My Property Qualities?

To qualify for the Section 179 deduction, your business must purchase long-term, tangible personal property (new or used) that’s used more than 50% of the time in your business operations. The IRS must determine that the property will last for over a year as well.

Section 179 deduction can be used for property purchased for both personal and business purposes, as long as the property is used primary for business (51% of the time). However, the amount of your overall deduction will be reduced by the percentage of personal use. It’s important for businesses to maintain records showing business use of the property.

The deduction doesn’t work for property used for personal purposes or to manage investments. If you use an item for business less than 51% of the time, use regular depreciation instead, deducting the cost of the item over the years. In addition, businesses aren’t allowed to convert property previously purchased and used for personal use to business use and claim a deduction for the cost.

Tangible Personal Property

A few examples of tangible personal property include business equipment/machinery, computers, computer software, and office furniture. Section 179 cannot be used to deduct the cost of the following:

- Inventory

- Land

- Intangible property such as patents, trademarks, and copyrights

- Permanent structures attached to land, including buildings, fences, paved parking areas, and swimming pools

- Air conditioning and heating units

- Property used outside of the United States

Limits for Section 179 Deduction

Section 179 allows businesses to write off $560,000; limiting the total amount of the equipment purchased and eligible for the deduction to $2,000,000. Section 179 deduction was designed primarily for small to mid-size businesses. All businesses that lease or purchase under $2 million of equipment during the year will qualify for the deduction.

Property Used in the United States

Section 179 expensing can be used for property purchased, not property that’s leased or inherited. Section 179 cannot be used for property purchased from a relative or an organization controlled by the buyer.

Under Section 179, there is a limit on the total amount of business property expenses that can be deducted each year. The limit was increased to $500,000 for 2010 until 2013. In 2014, the Section 179 limit is expected to decrease to $25,000. The limit does not apply to each business owned in separate locations, the limit applies to all of your businesses combined. If you do not wish to claim the full amount, the amount you don’t claim must be depreciated instead.

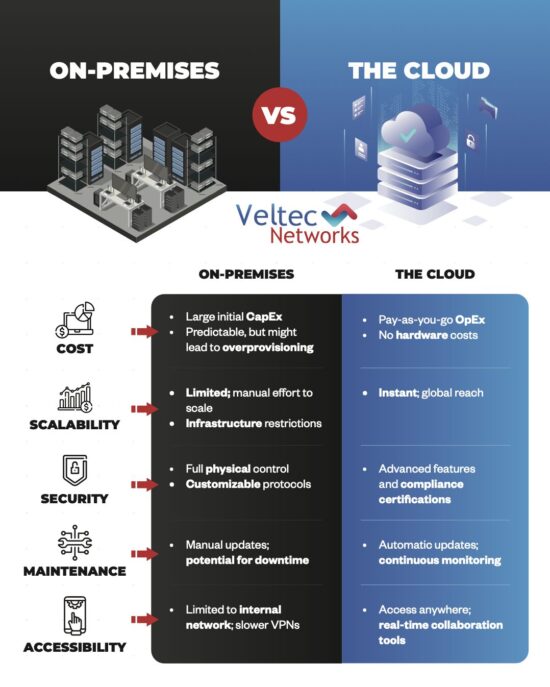

Looking at making an investment in new technology before the year end? Contact Veltec Networks and we can help you find the right IT solutions and help you maximize your Section 179 opportunities. Call (408) 849-4441 or email us at info@veltecnetworks.com to learn more on how your business can benefit from Section 179.